2013 Review: Economy & Markets

The financial markets encountered strong headwinds but little turbulence on the way to a record-setting year. 2013 has been described as a “year about nothing.” In reality, a lot happened—but nothing could challenge the market’s profitable run. Investors shrugged off news of a sluggish US recovery, recessions in China and Japan, threats of a US government shutdown, lingering euro zone debt problems, climbing interest rates, worsening turmoil in the Middle East, and stock market glitches.

The US and most developed market indexes experienced double-digit gains for the year. Overall, US stocks were up for the fifth year in a row while daily volatility fell to its lowest level in seven years. The Dow Jones Industrial Average posted a gain of 26.50%, its largest advance in 18 years. The S&P 500 Index had its best year since 1997, returning 32.39%. In the non-US developed markets, the MSCI-EAFE Index returned 22.78%, and all developed country markets in the MSCI indexes had positive returns. Emerging markets were the exception to the worldwide equity advance, as returns in many emerging countries turned negative, with the MSCI Emerging Markets Index returning -2.60% for the year.

During 2013, the yield on the 10-year Treasury note climbed from 1.76% to 3.01%―its largest increase since 2009. Rising interest rates left US fixed income indexes with either flat or negative returns, with longer-term and higher-quality bonds declining the most. TIPS performance was notably poor. Returns in the international bond markets were mixed and emerging market bond index returns were negative.

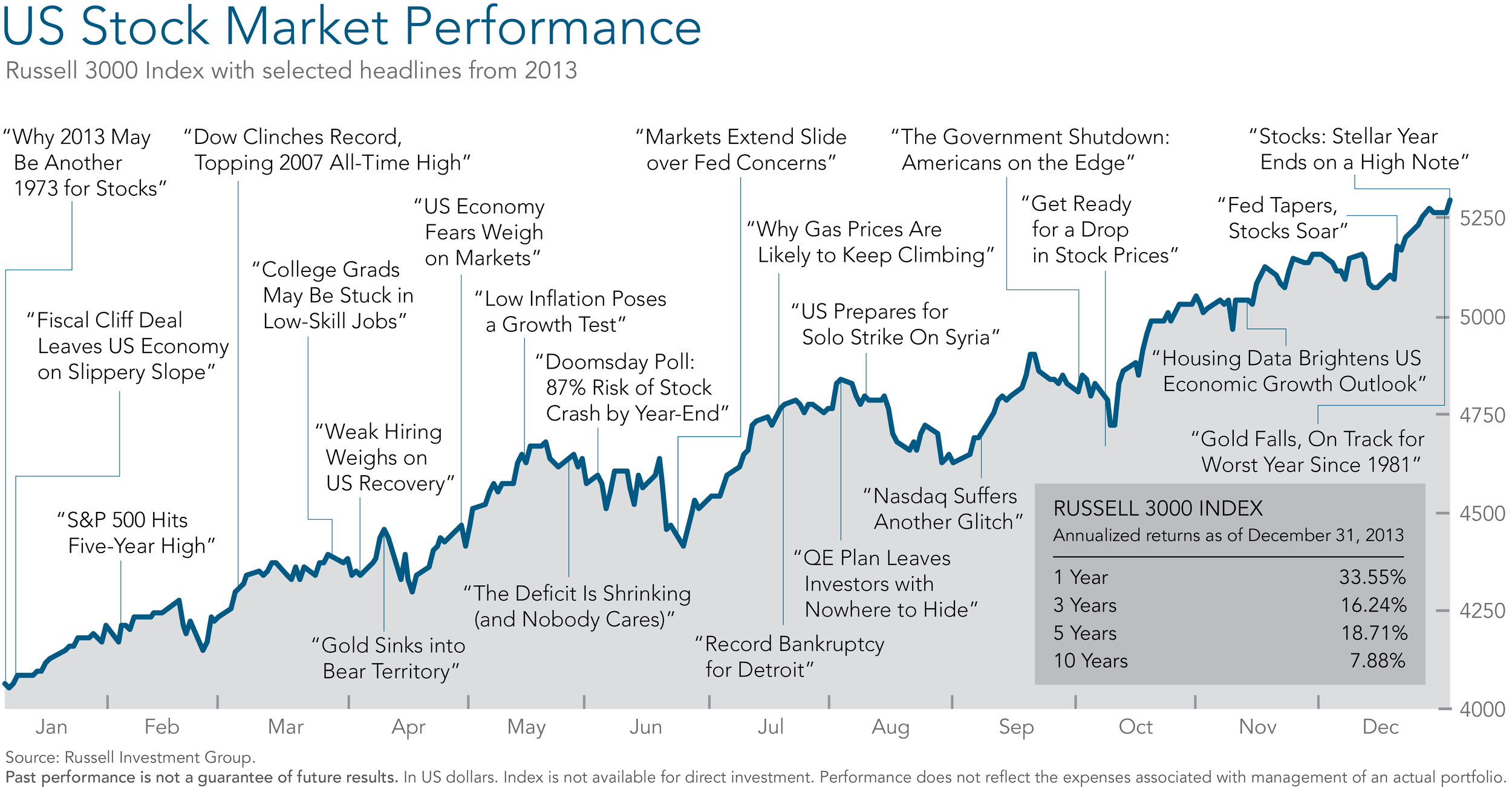

The above graph highlights some of the year’s prominent headlines in context of broad US market performance, as measured by the Russell 3000 Index. These headlines are not offered to explain market returns. Instead, they serve as a reminder that investors should view daily events from a longer-term perspective and avoid making investment decisions based solely on the news.

The world stock market performance chart below offers a snapshot of global stock market performance, as measured by the MSCI All Country World Index. The global headlines show that despite an abundance of negative news during the year, global stocks had an exceptional year.

Economic Backdrop

A Slow Recovery

The US economy quickened its pace slightly in 2013, overcoming the drag from higher payroll taxes and a slowdown in government spending due to sequestration cuts. Estimated GDP growth averaged 2.3% for the year, compared to 2.0% for the prior two calendar years. The improvement came in Q3, when growth jumped to 4.1%. Despite this recent spark, the recovery that began in 2009 is one of the weakest in the postwar era.

A few indicators pointed to gradually improving conditions during the second half of 2013. Positive signs included job market gains, lower inflation, rising wages, a revival in manufacturing, stronger auto sales, increased consumer spending, and improved corporate balance sheets and sustained business profits. The housing market also improved, although most of the gains in home prices and sales came earlier in the year. Rising stock prices and housing prices helped boost household net worth to a record level in Q3.

Monetary Power

The US Federal Reserve and Bank of Japan continued their monetary efforts to drive down long-term rates, keep short-term rates close to zero, and fuel economic growth. In the US, markets were anticipating when the Fed would dial back its quantitative easing program. The central bank hinted in May that it would begin reducing—or “tapering”—its monthly bond purchases. The message drove up US bond yields and briefly squelched markets, although the effect was short-lived in developed markets. Emerging countries felt the sharpest sting.

The Federal Reserve is likely to dial back or "taper" its quantitative easing program in 2014 as long as U.S. economic data continues to improve.

During the year, the Japan’s central bank began an aggressive bond-buying campaign designed to fend off recession, and the European bank was forced to cut interest rates in an effort to counteract rising joblessness and a deflationary threat in the Eurozone. Another surprise rate cut in November brought European rates to historical lows in an attempt to further boost the region’s fragile recovery.

Strong Business Fundamentals

In 2012, US corporate profits reached their highest level (as a share of GDP) in the post-war era. Few analysts expected a repeat in 2013. But through Q3, US businesses were on track for another strong year. Observers attribute rising profitability in a sluggish economy to productivity gains, falling wages, and relentless cost cutting among businesses. Rising profits have helped drive stock prices, but companies have been stockpiling the cash rather than reinvesting or distributing it.

It was the busiest year for initial public offerings since the financial crisis began, with a 59% jump in the number of US offerings and a 31% increase in cash raised compared to 2012. Companies took advantage of low interest rates by issuing a record amount of investment grade debt in 2013. The estimated $1.4 trillion in issuance surpassed the previous year’s record.

2013 Investment Overview

Quarterly Highlights

During Q1, the US equity markets logged strong returns. The quarterly return of the broad US market, as measured by the Russell 3000 Index, was over 11%, and the market’s daily volatility, as measured by the CBOE Volatility Index (VIX), fell sharply. Developed non-US markets also had a good quarter as economic conditions appeared to be improving. Japan’s latest effort to reverse more than two decades of deflation and economic stagnation was showing positive results and financial conditions in the euro zone, while still serious, were stabilizing.

After reaching all-time highs in May, the broad US stock market lost ground in June but managed to end the quarter with a strong gain of about 3%. Combined with Q1 advances, the market had its best mid-year start since the late 1990s. Daily volatility jumped by almost 33% in the quarter, partially as a result of increased uncertainty about the Fed’s announced monetary policy changes in the coming months. Volatility increased in non-US developed markets, including Europe, where economic conditions began to weaken and the central bank was forced to cut interest rates to offset deflationary pressures.

During Q3, the broad US market rebounded with a 6% quarterly gain despite investor concerns over the timing of the Fed’s monetary pullback and the US government’s debt limit. Developed non-US markets also had strong returns, especially in September, and outperformed both the US and emerging markets. Performance in Europe was particularly strong with the euro zone showing signs of an end to recession.

In Q4, equity markets climbed more than 10% and showed little concern from the government shutdown and the Fed’s confirmation of plans to begin tapering bond purchases in 2014. The European Central Bank again cut its benchmark interest rate in November to a record low in response to a sudden drop in the inflation rate.

Market Summary

All major US market indices had substantial gains for 2013. The S&P 500 logged a 32.39% total return. The NASDAQ Composite Index gained 40.14% and the Russell 2000, a popular benchmark for small company US stocks, returned 38.82%, its biggest gain since 1993. The stock market’s strong performance came with lower volatility, as gauged by the VIX, which fell for the second straight year to reach its lowest level since 2006.

Non-US developed stock markets also experienced strong gains. The MSCI World ex USA Index, a benchmark for large cap stocks in developed markets outside the US, returned 21.02%. The small cap and value versions of the index gained 25.55% and 21.47%, respectively. Emerging markets were the exception to the global market advance. The MSCI Emerging Markets Index returned -2.60%, with the small cap and value sub-indices returning 1.04% and -5.11%, respectively.

Among the equity markets tracked by MSCI, all countries in the developed markets had positive total returns (gross dividends; local currency), although the range of returns was broad (0.25% to 47.35%). Ireland, Finland, and Spain were the highest performers; Singapore, Australia, and Canada were the lowest performers. In the emerging markets tracked by MSCI, most countries logged negative total returns and the dispersion of returns was broad, ranging from -30.70% to 25.98%. Greece1, Egypt, and Taiwan were the top performing countries, while Turkey, Peru, and Indonesia logged the most negative returns.

The major world currencies were mixed relative to the US dollar. The euro gained 4.3% against the dollar—reaching a two-year high. The British pound gained 2% against the dollar. The Japanese yen experienced the biggest loss against the US dollar (21%) due to a combination of aggressive monetary easing and increased government spending. The Australian dollar gave up about 14% of its value against the US dollar.

Small cap and large cap stocks had strong performance in US and non-US developed markets, with small cap outperforming large cap in both markets. In the emerging markets, small cap slightly outperformed large cap, which had a negative return. Across the style spectrum, growth stocks and value stocks performed similarly in the US and non-US developed markets, and in emerging markets, growth stocks beat value stocks, although both had negative returns.

Returns of major fixed income indexes were either mixed or negative due to rising rates. One-year US Treasury Notes returned 0.25%; US government bonds -2.60%; world government bonds (1–5 years USD hedged) returned 0.62%; and US TIPS returned -8.61%.

Real estate securities had a relatively lackluster year: The Dow Jones US Select REIT Index returned 1.22% and S&P Global ex US REIT Index 2.36%. Commodities were negative for the third straight year, with the Dow Jones-UBS Commodity Index returning -9.52%. Within the index, gold returned -28.65% and silver -36.63%.

1. Standardized Performance Data and Disclosures

Russell data © Russell Investment Group 1995-2014, all rights reserved. Dow Jones data provided by Dow Jones Indexes. MSCI data copyright MSCI 2014, all rights reserved. S&P data provided by Standard & Poor’s Index Services Group. The BofA Merrill Lynch Indices are used with permission; © 2013 Merrill Lynch, Pierce, Fenner & Smith Inc.; all rights reserved. Citigroup bond indices copyright 2014 by Citigroup. Barclays data provided by Barclays Bank PLC. Indices are not available for direct investment; their performance does not reflect the expenses associated with the management of an actual portfolio.

Past performance is no guarantee of future results. This information is provided for educational purposes only and should not be considered investment advice or a solicitation to buy or sell securities. Diversification does not guarantee investment returns and does not eliminate the risk of loss.

Investing risks include loss of principal and fluctuating value. Small cap securities are subject to greater volatility than those in other asset categories. International investing involves special risks such as currency fluctuation and political instability. Investing in emerging markets may accentuate these risks. Sector-specific investments can also increase these risks.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Fixed-income investments are subject to various other risks including changes in credit quality, liquidity, prepayments, and other factors. REIT risks include changes in real estate values and property taxes, interest rates, cash flow of underlying real estate assets, supply and demand, and the management skill and creditworthiness of the issuer.

Lake Tahoe Wealth Management, LLC is an investment advisor registered in the States of Nevada, New York, North Carolina, South Carolina, and Texas.

Principal Risks:

The principal risks of investing may include one or more of the following: market risk, small companies risk, risk of concentrating in the real estate industry, foreign securities risk and currencies risk, emerging markets risk, banking concentration risk, foreign government debt risk, interest rate risk, risk of investing for inflation protection, credit risk, risk of municipal securities, derivatives risk, securities lending risk, call risk, liquidity risk, income risk. Value investment risk. Investing strategy risk. To more fully understand the risks related to investment in the funds, investors should read each fund’s prospectus.

Investments in foreign issuers are subject to certain considerations that are not associated with investment in US public companies. Investment in the International Equity, Emerging Markets Equity and the Global Fixed Income Portfolios and Indices will be denominated in foreign currencies. Changes in the relative value of these foreign currencies and the US dollar, therefore, will affect the value of investments in the Portfolios. However, the Global Fixed Income Portfolios and Indices may utilize forward currency contracts to attempt to protect against uncertainty in the level of future currency rates (if applicable), to hedge against fluctuations in currency exchange rates or to transfer balances from one currency to another. Foreign Securities prices may decline or fluctuate because of (a) economic or political actions of foreign governments, and/or (b) less regulated or liquid securities markets.

The Real Estate Indices are each concentrated in the real estate industry. The exclusive focus by Real Estate Securities Portfolios on the real estate industry will cause the Real Estate Securities Portfolios to be exposed to the general risks of direct real estate ownership. The value of securities in the real estate industry can be affected by changes in real estate values and rental income, property taxes, and tax and regulatory requirements. Also, the value of securities in the real estate industry may decline with changes in interest rate. Investing in REITS and REIT-like entities involves certain unique risks in addition to those risks associated with investing in the real estate industry in general. REITS and REIT-like entities are dependent upon management skill, may not be diversified, and are subject to heavy cash flow dependency and self-liquidations. REITS and REIT-like entities also are subject to the possibility of failing to qualify for tax free pass through of income. Also, many foreign REIT-like entities are deemed for tax purposes as passive foreign investment companies (PFICs), which could result in the receipt of taxable dividends to shareholders at an unfavorable tax rate. Also, because REITS and REIT-like entities typically are invested in a limited number of projects or in a particular market segment, these entities are more susceptible to adverse developments affecting a single project or market segment than more broadly diversified investments. The performance of Real Estate Securities Portfolios may be materially different from the broad equity market.

Fixed Income Portfolios:

The net asset value of a fund that invests in fixed income securities will fluctuate when interest rates rise. An investor can lose principal value investing in a fixed income fund during a rising interest rate environment. The Portfolio may also be affected by: call risk, which is the risk that during periods of falling interest rates, a bond issuer will call or repay a higher-yielding bond before its maturity date; credit risk, which is the risk that a bond issuer will fail to pay interest and principal in a timely manner.

Risk of Banking Concentration:

Focus on the banking industry would link the performance of the short term fixed income indices to changes in performance of the banking industry generally. For example, a change in the market’s perception of the riskiness of banks compared to non-banks would cause the Portfolio’s values to fluctuate.

The material is solely for informational purposes and shall not constitute an offer to sell or the solicitation to buy securities. The opinions expressed herein represent the current, good faith views of Lake Tahoe Wealth Management, LLC (LTWM) as of the date indicated and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented in this presentation has been developed internally and/or obtained from sources believed to be reliable; however, LTWM does not guarantee the accuracy, adequacy or completeness of such information.

Predictions, opinions, and other information contained in this presentation are subject to change continually and without notice of any kind and may no longer be true after the date indicated. Any forward-looking statements speak only as of the date they are made, and LTWM assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward looking statements. No investment strategy can guarantee performance results. All investments are subject to investment risk, including loss of principal invested.

Lake Tahoe Wealth Management, LLC is an investment advisor registered in the States of Nevada, New York, North Carolina, South Carolina, and Texas.