New IRS Life Expectancy Tables and Required Minimum Distributions

In November of 2020 the IRS published new tables for Required Minimum Distributions (RMD) in accordance with the SECURE ACT of 2019. Among the many provisions in the act, the life expectancies tables were to be updated and the age for beginning RMDs was increased to 72, up from 70 ½. With updated life expectancies, which assume a longer life, (the old tables were decades old) the new tables provide a larger divisor for each age which results in a smaller Required Minimum Distribution for that age.

The new tables are in place for distribution years beginning January 1, 2022, and later. If 2021 was the first year you had a RMD and you delayed taking in until early 2022 (which is only allowed for the initial distribution from your own account(s) i.e. you turned 72 in 2021) you must use the old tables for the 2021 distribution amount even if taking the distribution in 2022.

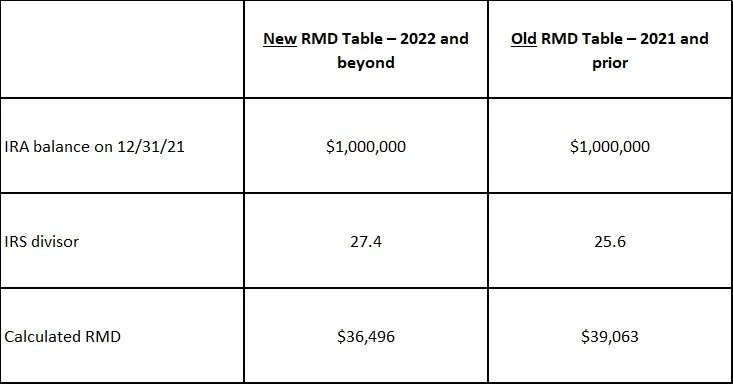

A straightforward example of how the new tables reduce RMD is a 72-year-old in 2022 has a divisor of 27.4 (new table) instead of 25.6 (previous table). If this 72-year-old has an IRA balance from 12/31/2021 of $1,000,000 then their RMD for 2022 is $36,496 ($1,000,000/27.4). With the old tables it would have been $39,063 ($1,000,000/25.6).

For most people it is as simple as using the new table to determine RMD for 2022. For those with inherited IRAs where the previous account owner died after January 1, 2020, the SECURE Act rules apply and only spouses and a small number of others are considered “Eligible Designated Beneficiaries” that have options involving the life expectancy table. When the IRA owner dies after January 1, 2020, most non-spousal IRA beneficiaries are subject to the 10-year distribution rule which was part of the SECURE Act of 2019.

Those that have inherited IRAs from someone who died prior to January 1, 2020, have the most complexity as they are considered “grandfathered” under the old rules and if they have been meeting the RMD annually can continue to use their own life expectancy. There is one-time reset in these situations adjusting for the difference between the old and new tables based on the year the original owner died.

There are also rare occasions with additional nuances such as when the beneficiary is older than the deceased account owner or if the beneficiary is an estate, a charity or a trust that is not a “see-through” trust. Potentially the most complex situation is when prior to death the deceased account owner had begun but not yet concluded a series of substantially equal periodic payments under IRS section 72(t).

No matter what your situation, it is always beneficial to coordinate with a tax professional and financial planner on how to receive assets most efficiently from a qualified or inherited qualified account.