Executive Summary

As you've likely noticed, the US stock market has awakened from it months-long slumber. Understandably, this has caused many investors to take note and wonder, what's up and what do we need to do? Let's start with the answer to the first question and then we will address the second part of the question.

What's up with these markets?

We spoke about the extreme stock run up in our last quarterly market commentary (http://www.laketahoewealthmanagement.com/blog/lake-tahoe-wealth-manageme...) as irrational. The 2017 run up was followed by January 2018 where the US stock market rose by more than 6% and peaked on January 26th. We've now witnessed a correction of 10% from the highs and stocks are now negative for the first quarter in 2018. There are several news stories contributing to a repricing of stocks:

- Volatility spiked to the highest level on record February 8th (partly due to the crowded inverse volatility trade) and has remained elevated since the spike.

- The Fed is raising short term rates, but longer maturity interest rates remain low, causing a flattening of the yield curve, which tends to predict economic weakness.

- Tech stocks, which have the highest valuations, are being led down by Facebook (privacy issues), Tesla (production issues) and Amazon (gov’t regulation issues).

- Trump’s tough talk on tariffs is creating a real trade war with China, which is causing a dip in GDP growth forecasts.

- Bitcoin and other digital currencies are down significantly this year, from bubble levels last year.

- Valuations levels are still very high for all measures except the forward year EPS P/E ratio, which gets the most media coverage (the P/E 10, Tobin’s Q and P/S ratio, which are not heavily influenced by a changing corporate tax rate are near all-time high levels).

The tax reform package, which increased business confidence, has now been replaced with business skepticism and the potential for a larger than expected trade war, which is still in the very early stages of negotiation. Actual trade wars and protectionism reduce multi-national corporate revenue and global GDP growth. Stocks in the U.S. declined sharply on news that the Trump administration is working on new tariffs associated with stolen intellectual property, which in turn is primarily associated with China. China responded with actual tariffs on hundreds of U.S. imports. The bond market reacted as expected, in a risk-off situation, and the yield on the 10-year Treasury declined from highs of 2.92% to 2.7% in the first week of April. Now that the high-flying, tech-heavy Nasdaq Index has entered correction territory, down 10%, joining the other major stock market indices, we are likely going to remain in the correction process for a lot longer than many investors would like. LTWM portfolios are well positioned for long term financial plan success.

It's important to note that 2017 was unnaturally calm. So the above-average volatility we've experienced since the beginning of February likely feels much worse than it actually is. Consider this, there have been fours weeks in 2018 of lower performance than any week in 2017; however, there have already been five weeks that realized higher performance than any week in all of 2017. Market volatility has indeed returned.

Should we do anything different? No. A well designed financial plan incorporates portfolio expectations. We create our clients' portfolios with the expectation that there will be market volatility and corrections. When market valuations get lofty, as mentioned above, we have a process for risk mitigation in the portfolios. When the inevitable downturns do occur, we have a rebalancing process that takes advantage of the price movement by selling what is doing well (in this environment - bonds, cash) and buying what is cheaper (stocks). One cannot and should not react emotionally to markets. A prudent investor already has their plan in place and knows what they will do in any market conditions. Maintaining a long term focus is critical for your success as an investor, we are here to support you in your success.

For those who want to dive deeper into our market and economic commentary:

World Asset Class 1st Quarter 2018 Index Returns

First quarter index returns were negative for U.S., global real estate and international developed stocks; and positive for emerging market stocks. The large decline in real estate stocks was due to the increase in interest rates, which reduces corporate profit margins and may be related to the U.S. tax reform package, which capped real estate tax deductibility (REIT losses were greater in the U.S):

A larger sample of asset class returns shows the continued strength of emerging market stocks, small cap stocks were stronger than large cap stocks (Russell 2000 SC index ahead of Russell 1000 LC index) and value stocks continued to be weaker than growth stocks.

Here are additional details for the U.S. stock market:

Bond market values around the world declined due to a shift up in the yield curve, which was slightly more at the short end than at the long end. The larger upward shift at the short end, caused a slight flattening of the curve. As a reminder, a steep curve is associated with strong economic expectations and a flat or inverted curve signals future economic weakness. Here is the shift up in rates, notice the larger move up for the short end (maturities of 5 years and less) during the first quarter:

For the first quarter, the yield on the 5-year Treasury note rose 36 basis points (bps), ending at 2.56%. The yield on the 10-year Treasury note increased 34 bps to 2.74%. The 30-year Treasury bond yield rose 23 bps to finish at 2.97%. Most bond analysts were expecting the long end of the curve to shift up with the rest of the curve, since the Federal Reserve was raising short term rates and reducing bond purchases. However, the long end of curve continues to be resistant to increasing rates and the 10 year treasury has failed to cross above the level of 2.94% numerous times. The Fed has raised the overnight lending rate a quarter point, up to 1.75%, so far this year. Notice the high yield bond sector is still performing well over the past year, a sign of economic strength.

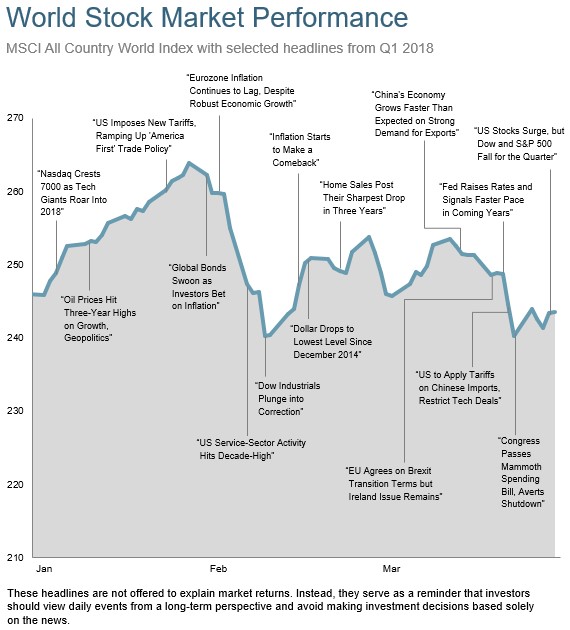

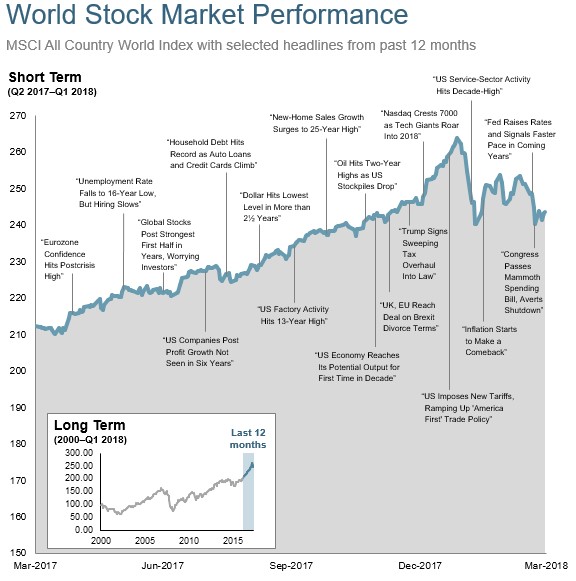

One cannot time markets and the short term news cycle is just noise. Here is a sample of how the global stock market responded to headlines news during the first quarter (notice the insert of the second graph that compares the last 12 months to the long term):

CONCLUSION

The first quarter decline in stocks happened while corporate earnings were expanding. This is the first reversal of the five-year trend of stock prices increasing faster than corporate profits, which means the P/E ratio for 2018 and 2019 EPS have finally contracted, ending the trend of expanding valuation levels. However, the P/E 10 ratio (price divided by 10 years of earnings) is only down to 31.7, from 32.1 at the end of 2017 and still well above two standard deviations above the mean valuation level. More P/E 10 details are available at https://www.advisorperspectives.com/dshort/updates/2018/04/02/is-the-stock-market-cheap. If we look at the S&P 500 price to sales ratio, it is currently 2.16 vs. 2.35 and the end of 2017 and 2.01 one year ago (the median value is 1.44). Global debt levels are still very high. U.S. corporations have added over a trillion dollars of BBB rated debt, which could easily become junk if a recession were to hit. We are closely watching bond markets for any increase in credit spreads or spike in interest rates that could cause a deeper correction. It is wise to be prudent and we will continue to be aware of these hurdles facing the market. We will continue to exercise caution in the coming weeks as more companies provide earnings guidance for 2018; and stock analysts adjust their earnings expectations. We will also be watching for any catalyst that could cause a significant re-pricing of risky asset classes, since the simplest of issues could cause a meaningful correction with asset valuations at extremely high levels.

Please enjoy this timely article from our friends at Dimensional Fund Advisors:

Embarking on a financial plan is like sailing around the world. The voyage won’t always go to plan, and there’ll be rough seas. But the odds of reaching your destination increase greatly if you are prepared, flexible, patient, and well-advised.

A mistake many inexperienced sailors make is not having a plan at all. They embark without a clear sense of their destination. And once they do decide, they often find themselves lost at sea in the wrong boat with inadequate provisions.

Likewise, in planning an investment journey, you need to decide on your goal. A first step might be to consider whether the goal is realistic and achievable. For instance, while you may long to retire in the south of France, you may not be prepared to sacrifice your needs today to satisfy that distant desire.

Once you are set on a realistic destination, you need to ensure you have the right portfolio to get you there. Have you planned for multiple contingencies? What degree of “bad weather” can your plan withstand along the way?

Key to a successful voyage is a good navigator. A trusted advisor is like that, regularly taking coordinates and making adjustments, if necessary. If your circumstances change, the advisor may suggest you replot your course.

As with the weather at sea, markets can be unpredictable. A sudden squall can whip up waves of volatility, tides can shift, and strong currents can threaten to blow you off course. Like a seasoned sailor, an experienced advisor will work with the conditions.

Once the storm passes, you can pick up speed again. Just as a sturdy vessel will help you withstand most conditions at sea, a well-diversified portfolio can act as a bulwark against the sometimes tempestuous conditions in markets.

Circumnavigating the globe is not exciting every day. Patience is required with local customs and paperwork as you pull into different ports. Likewise, a lack of attention to costs and taxes is the enemy of many a long-term financial plan.

Distractions can also send investors, like sailors, off course. In the face of “hot” investment trends, it takes discipline not to veer from your chosen plan. Like the sirens of Greek mythology, media pundits can also be diverting, tempting you to change tack and act on news that is already priced in to markets.

A lack of flexibility is another impediment to a successful investment journey. If it doesn’t look as though you’ll make your destination in time, you may have to extend your voyage, take a different route to get there, or even moderate your goal.

The important point is that you become comfortable with the idea that uncertainty is inherent to the investment journey, just as it is with any sea voyage. That is why preparation and planning are so critical. While you can’t control every outcome, you can be prepared for the range of possibilities and understand that you have clear choices if things don’t go according to plan.

If you can’t live with the volatility, you can change your plan. If the goal looks unachievable, you can lower your sights.

If it doesn’t look as if you’ll arrive on time, you can extend your journey.

Of course, not everyone’s journey is the same. Neither is everyone’s destination. We take different routes to different places, and we meet a range of challenges and opportunities along the way.

But for all of us, it’s critical that we are prepared for our journeys in the right vessel, keep our destinations in mind, stick with the plans, and have a trusted navigator to chart our courses and keep us on target.

Adapted from “Sailing with the Tides,” Outside the Flags by Jim Parker, March 2018. Past performance is no guarantee of future results. There is no guarantee an investing strategy will be successful. Diversification does not eliminate the risk of market loss. All expressions of opinion are subject to change. This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

1. Standardized Performance Data and Disclosures

Russell data © Russell Investment Group 1995-2017, all rights reserved. Dow Jones data provided by Dow Jones Indexes. MSCI data copyright MSCI 2017, all rights reserved. S&P data provided by Standard & Poor’s Index Services Group. The BofA Merrill Lynch Indices are used with permission; © 2017 Merrill Lynch, Pierce, Fenner & Smith Inc.; all rights reserved. Citigroup bond indices copyright 2017 by Citigroup. Barclays data provided by Barclays Bank PLC. Indices are not available for direct investment; their performance does not reflect the expenses associated with the management of an actual portfolio.

Past performance is no guarantee of future results. This information is provided for educational purposes only and should not be considered investment advice or a solicitation to buy or sell securities. Diversification does not guarantee investment returns and does not eliminate the risk of loss.

Investing risks include loss of principal and fluctuating value. Small cap securities are subject to greater volatility than those in other asset categories. International investing involves special risks such as currency fluctuation and political instability. Investing in emerging markets may accentuate these risks. Sector-specific investments can also increase these risks.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Fixed-income investments are subject to various other risks including changes in credit quality, liquidity, prepayments, and other factors. REIT risks include changes in real estate values and property taxes, interest rates, cash flow of underlying real estate assets, supply and demand, and the management skill and creditworthiness of the issuer.

Principal Risks:

The principal risks of investing may include one or more of the following: market risk, small companies risk, risk of concentrating in the real estate industry, foreign securities risk and currencies risk, emerging markets risk, banking concentration risk, foreign government debt risk, interest rate risk, risk of investing for inflation protection, credit risk, risk of municipal securities, derivatives risk, securities lending risk, call risk, liquidity risk, income risk. Value investment risk. Investing strategy risk. To more fully understand the risks related to investment in the funds, investors should read each fund’s prospectus.

Investments in foreign issuers are subject to certain considerations that are not associated with investment in US public companies. Investment in the International Equity, Emerging Markets Equity and the Global Fixed Income Portfolios and Indices will be denominated in foreign currencies. Changes in the relative value of these foreign currencies and the US dollar, therefore, will affect the value of investments in the Portfolios. However, the Global Fixed Income Portfolios and Indices may utilize forward currency contracts to attempt to protect against uncertainty in the level of future currency rates (if applicable), to hedge against fluctuations in currency exchange rates or to transfer balances from one currency to another. Foreign Securities prices may decline or fluctuate because of (a) economic or political actions of foreign governments, and/or (b) less regulated or liquid securities markets.

The Real Estate Indices are each concentrated in the real estate industry. The exclusive focus by Real Estate Securities Portfolios on the real estate industry will cause the Real Estate Securities Portfolios to be exposed to the general risks of direct real estate ownership. The value of securities in the real estate industry can be affected by changes in real estate values and rental income, property taxes, and tax and regulatory requirements. Also, the value of securities in the real estate industry may decline with changes in interest rate. Investing in REITS and REIT-like entities involves certain unique risks in addition to those risks associated with investing in the real estate industry in general. REITS and REIT-like entities are dependent upon management skill, may not be diversified, and are subject to heavy cash flow dependency and self-liquidations. REITS and REIT-like entities also are subject to the possibility of failing to qualify for tax free pass through of income. Also, many foreign REIT-like entities are deemed for tax purposes as passive foreign investment companies (PFICs), which could result in the receipt of taxable dividends to shareholders at an unfavorable tax rate. Also, because REITS and REIT-like entities typically are invested in a limited number of projects or in a particular market segment, these entities are more susceptible to adverse developments affecting a single project or market segment than more broadly diversified investments. The performance of Real Estate Securities Portfolios may be materially different from the broad equity market.

Fixed Income Portfolios:

The net asset value of a fund that invests in fixed income securities will fluctuate when interest rates rise. An investor can lose principal value investing in a fixed income fund during a rising interest rate environment. The Portfolio may also be affected by: call risk, which is the risk that during periods of falling interest rates, a bond issuer will call or repay a higher-yielding bond before its maturity date; credit risk, which is the risk that a bond issuer will fail to pay interest and principal in a timely manner.

Risk of Banking Concentration:

Focus on the banking industry would link the performance of the short term fixed income indices to changes in performance of the banking industry generally. For example, a change in the market’s perception of the riskiness of banks compared to non-banks would cause the Portfolio’s values to fluctuate.

The material is solely for informational purposes and shall not constitute an offer to sell or the solicitation to buy securities. The opinions expressed herein represent the current, good faith views of Lake Tahoe Wealth Management, Inc. (LTWM) as of the date indicated and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented in this presentation has been developed internally and/or obtained from sources believed to be reliable; however, LTWM does not guarantee the accuracy, adequacy or completeness of such information.

Predictions, opinions, and other information contained in this presentation are subject to change continually and without notice of any kind and may no longer be true after the date indicated. Any forward-looking statements speak only as of the date they are made, and LTWM assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward looking statements. No investment strategy can guarantee performance results. All investments are subject to investment risk, including loss of principal invested.

Lake Tahoe Wealth Management, Inc.is a Registered Investment Advisory Firm with the Securities Exchange Commission.